News & Reading >>Knowledge >>Incoterms 2000 - International Commercial Terms

Incoterms 2000 - International Commercial Terms: FOB, CIF, CFR, CNF, EXW

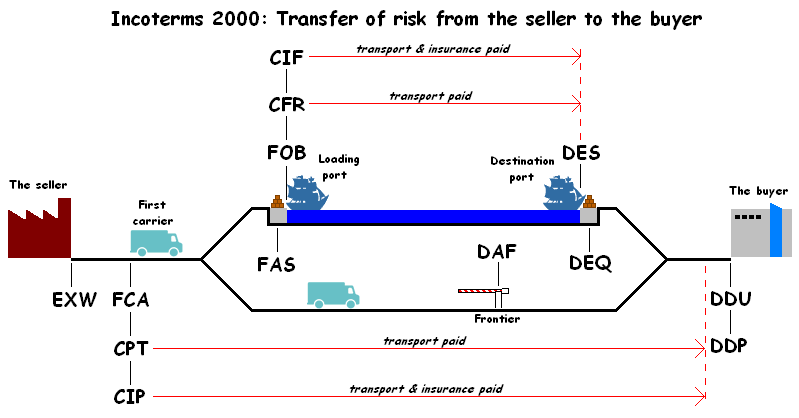

Understanding Incoterms

Incoterms or international commercial terms are a series of international sales terms, published by International Chamber of Commerce (ICC) and widely used in international commercial transactions. They are used to divide transaction costs and responsibilities between buyer and seller and reflect state-of-the-art transportation practices. They closely correspond to the U.N. Convention on Contracts for the International Sale of Goods. The first version was introduced in 1936 and the present dates from 2000.

Incoterms are standard trade definitions most commonly used in international sales contracts. Devised and published by the International Chamber of Commerce, they are at the heart of world trade.

Among the best known Incoterms are EXW (Ex works), FOB (Free on Board), CIF (Cost, Insurance and Freight), DDU (Delivered Duty Unpaid), and CPT (Carriage Paid To).

ICC introduced the first version of Incoterms - short for "International Commercial Terms" - in 1936. Since then, ICC expert lawyers and trade practitioners have updated them six times to keep pace with the development of international trade.

ICC is currently revising Incoterms 2000. The new edition, Incoterms 2011, is expected to enter into force on 1 January 2011.

Most contracts made after 1 January 2000 will refer to the latest edition of Incoterms, which came into force on that date. The correct reference is to "Incoterms 2000". Unless the parties decide otherwise, earlier versions of Incoterms - like Incoterms 1990 - are still binding if incorporated in contracts that are unfulfilled and date from before 1 January 2000.

Versions of Incoterms preceding the 2000 edition may still be incorporated into future contracts if the parties so agree. However, this course is not recommended because the latest version is designed to bring Incoterms into line with the latest developments in commercial practice.

The English text is the original and official version of Incoterms 2000, which have been endorsed by the United Nations Commission on International Trade Law (UNCITRAL). Authorized translations into 31 languages are available from ICC national committees.

Correct use of Incoterms goes a long way to providing the legal certainty upon which mutual confidence between business partners must be based. To be sure of using them correctly, trade practitioners need to consult the full ICC texts, and to beware of the many unauthorized summaries and approximate versions that abound on the web.

As the guardian and originator of Incoterms, ICC has a responsibility to consult regularly all parties interested in international trade to keep Incoterms relevant, efficient and up-to-date. This is a long and costly process for ICC, which is a non-governmental, self-financed organization. The work is financed out of sales of Incoterms 2000 and related publications, which are protected by copyright.

Group E – Departure

EXW – Ex Works (named place)

The seller makes the goods available at his premises. The buyer is responsible for all charges.

This term may be the easiest to administer, however may not be in the seller's best interests. There is no control over the final destination of the goods. It may be possible for the seller to negotiate better freight rates than the buyer. A vehicle arriving to take delivery of the seller's goods under EXW may not be suitable for carriage.

Group F – Main carriage unpaid

FCA – Free Carrier (named place)

The seller hands over the goods, cleared for export, into the custody of the first carrier (named by the buyer) at the named place. This term is suitable for all modes of transport, including carriage by air, rail, road, and containerised / multi-modal transport.

FAS – Free Alongside Ship (named loading port)

The seller must place the goods alongside the ship at the named port. The seller must clear the goods for export; this changed in the 2000 version of the Incoterms. Suitable for maritime transport only.

FOB – Free on board (named loading port)

The classic maritime trade term. The seller must load the goods on board the ship nominated by the buyer, cost and risk being divided at ship's rail. The seller must clear the goods for export. Maritime transport only. It also includes Air transport when the seller is not able to export the goods on the schedule time mentioned in the letter of credit. In this case the seller allows a deduction of sum equivalent to the carriage by ship from the air carriage.

Group C – Main carriage paid

CFR – Cost and Freight (named destination port)

Seller must pay the costs and freight to bring the goods to the port of destination. However, risk is transferred to the buyer once the goods have crossed the ship's rail. Maritime transport only.

CIF – Cost, Insurance and Freight (named destination port)

Exactly the same as CFR except that the seller must in addition procure and pay for insurance for the buyer. Maritime transport only.

CPT – Carriage Paid To (named place of destination)

The general/containerised/multimodal equivalent of CFR. The seller pays for carriage to the named point of destination, but risk passes when the goods are handed over to the first carrier.

CIP – Carriage and Insurance Paid (To) (named place of destination)

The containerised transport/multimodal equivalent of CIF. Seller pays for carriage and insurance to the named destination point, but risk passes when the goods are handed over to the first carrier.

Group D – Arrival

DAF – Delivered At Frontier (named place)

This term can be used when the goods are transported by rail and road. The seller pays for transportation to the named place of delivery at the frontier. The buyer arranges for customs clearance and pays for transportation from the frontier to his factory. The passing of risk occurs at the frontier.

DES – Delivered Ex Ship (named port)

Where goods are delivered ex ship, the passing of risk does not occur until the ship has arrived at the named port of destination and the goods made available for unloading to the buyer. The seller pays the same freight and insurance costs as he would under a CIF arrangement. Unlike CFR and CIF terms, the seller has agreed to bear not just cost, but also Risk and Title up to the arrival of the vessel at the named port. Costs for unloading the goods and any duties, taxes, etc… are for the Buyer. A commonly used term in shipping bulk commodities, such as coal, grain, dry chemicals - - - and where the seller either owns or has chartered, their own vessel.

DEQ – Delivered Ex Quay (named port)

This is similar to DES, but the passing of risk does not occur until the goods have been unloaded at the port of destination.

DDU – Delivered Duty Unpaid (named destination place)

This term means that the seller delivers the goods to the buyer to the named place of destination in the contract of sale. The goods are not cleared for import or unloaded from any form of transport at the place of destination. The buyer is responsible for the costs and risks for the unloading, duty and any subsequent delivery beyond the place of destination. However, if the buyer wishes the seller to bear cost and risks associated with the import clearance, duty, unloading and subsequent delivery beyond the place of destination, then this all needs to be explicitly agreed upon in the contract of sale.

DDP – Delivered Duty Paid (named destination place)

This term means that the seller pays for all transportation costs and bears all risk until the goods have been delivered and pays the duty. Also used interchangeably with the term "Free Domicile". The most comprehensive term for the buyer. In most of the importing countries, taxes such as (but not limited to) VAT and excises should not be considered prepaid being handled as a "refundable" tax. Therefore VAT and excises usually are not representing a direct cost for the importer since they will be recovered against the sales on the local (domestic) market.

Summary of terms

For a given term, "Yes" indicates that the seller has the responsibility to provide the service included in the price. "No" indicates it is the buyer's responsibility. If insurance is not included in the term (for example, CFR) then insurance for transport is the responsibility of the buyer or the seller depending on who owns the cargo at time of transport. In the case of CFR terms, it would be the buyer while in the case of DDU or DDP terms, it would be the seller.